will capital gains tax rate increase in 2021

Irs 2023 Capital Gains Tax Rates. 4 rows If you realize long-term capital gains from the sale of collectibles such as precious metals.

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Tax rate for capital gains.

. The proposal would increase the maximum stated capital gain rate from 20 to 25. Capital gains rates for individual. The Chancellor acknowledged the difficulties facing homeowners and businesses after the Bank put up its base rate from 225 per cent to 3 per cent on Thursday the highest for.

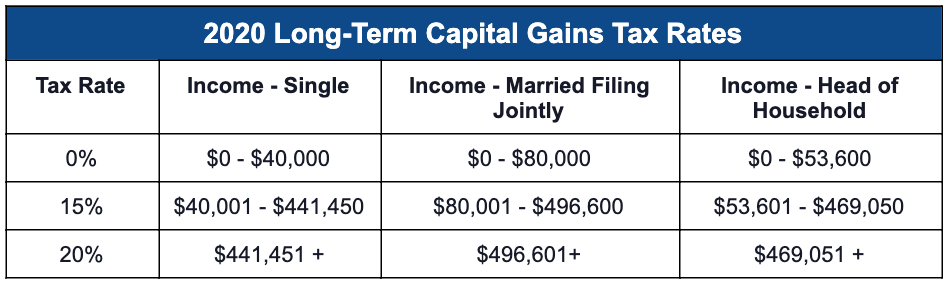

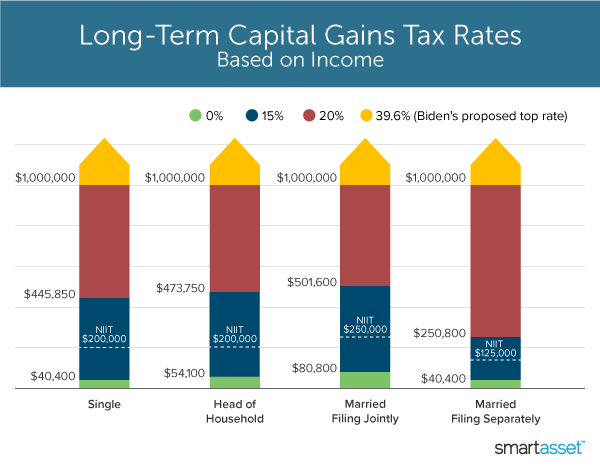

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Basic rate payers and higheradditional rate payers.

Married separately taxable income. 2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains For Unmarried Individuals Taxable Income Over For Married Individuals Filing Joint Returns. If your ordinary tax rate is lower than 28.

Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high as 28. The Times reports that the Chancellor is considering an increase in the dividend tax rate by 125 and a cut to the 2000 tax-free dividend allowance perhaps halving it. Married joint taxable income.

In 2021 the higher 288 long-term capital gains rate will be applied 3 to single taxpayers whose adjusted gross income exceeds 523601 and 628301 for taxpayers filing married. Increase Tax Rate on Capital Gains Current Law. Head of home taxable income.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent. The proposal would be effective for taxable years beginning after December 31 2021. Most realized long-term capital.

Over the 20202021 tax year the basic rate on. Private Wealth Services Partner Christopher Boyett was quoted in a Bloomberg article on President Joe Bidens expected proposal to nearly double the capital gains tax rate. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate.

Increasing the top capital-gains rate and lowering the income thresholds at which that top rate applies would raise 123 billion over the next decade according to an. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. However it was struck down in March 2022.

The effective date for this increase would be September 13 2021. By Charlie Bradley 0700 Thu Oct 28. CGT rates differ from income tax rates and are in two broad brackets.

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Potential Increase In Capital Gains Tax Drives Business Owners To Seek Timely Exits Fe International

What S In Biden S Capital Gains Tax Plan Smartasset

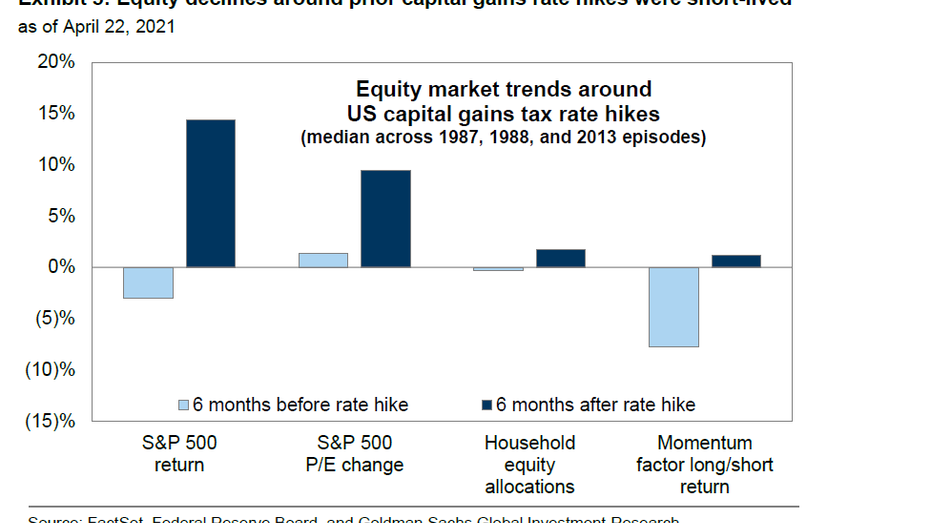

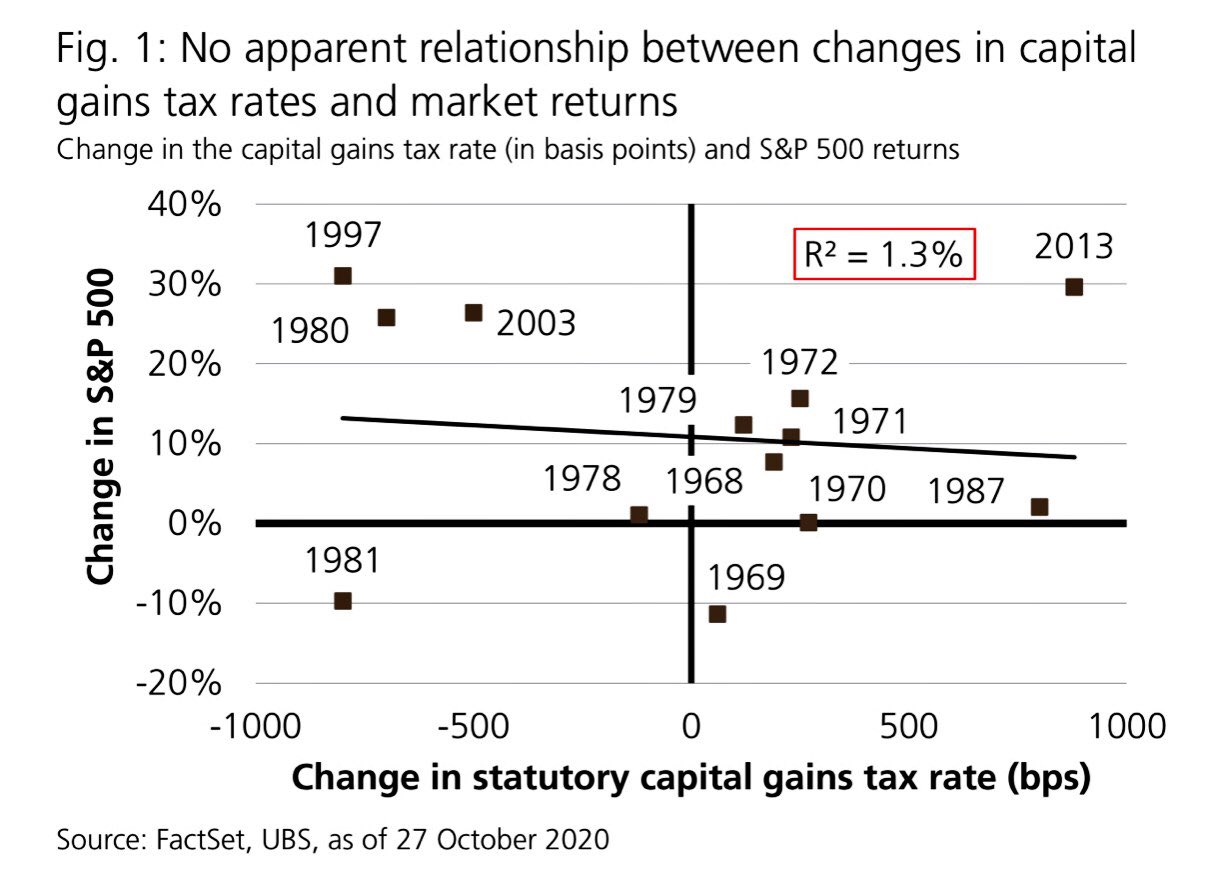

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

What You Need To Know About Capital Gains Tax

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Managing Tax Rate Uncertainty Russell Investments

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

What Are Capital Gains Taxes And How Could They Be Reformed

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Capital Gains Tax What Is It When Do You Pay It

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Hike Won T Affect Stock Market Experts Say But Wealthy Scramble

Real Estate Capital Gains Tax Rates In 2021 2022

White House Considers Capital Gains Tax Cut Neutral Cost Recovery